Other insurance companies billed much greater rates after a DUI. Actually, the remainder of the ideal insurance providers included in our study essentially doubled their premiums compared to what they supplied a motorist with a tidy document. As a result of this, it's particularly vital to compare quotes from a number of firms when purchasing auto insurance with a DRUNK DRIVING.

vehicle insure auto carsauto vehicle insurance cheap car insurance cheapest car

vehicle insure auto carsauto vehicle insurance cheap car insurance cheapest car

This is primarily since more youthful vehicle drivers are more probable to enter into crashes than older chauffeurs. That greater risk triggers insurance business to charge greater rates to teen chauffeurs, as well as those that are a few years older. Just how much greater? A typical 19-year-old chauffeur in Michigan pays $359 per month for minimum-coverage car insurance, according to our evaluation, while an ordinary 30-year-old driver pays $186 monthly (cheap insurance).

It was likewise amongst the top insurance coverage business for each of these age groups. We didn't highlight USAA below, though, since just experts, current participants of the military as well as some of their family participants certify for coverage.

All material and also solutions provided on or through this website are supplied "as is" and also "as available" for usage. Quote, Wizard. vans. com LLC makes no representations or warranties of any kind, reveal or suggested, as to the procedure of this site or to the info, web content, products, or products included on this site.

Michigan has several of the most detailed insurance policy laws in the country when it concerns no-fault insurance coverage. That additionally suggests citizens right here pay the greatest car insurance prices in the United States. Just how much is vehicle insurance coverage in Michigan? Some study shows that Michigan motorists pay $ 2200 a year in automobile insurance policy generally compared to $1250 throughout the united state

Indicators on More Than $900m In Auto Insurance Refunds Returned To ... You Should Know

Nevertheless, if the amount of problems in a mishap goes beyond the amount of car insurance coverage you carry, you will certainly have to pay of pocket for the exceptional expenses (insured car). Although one in five Michigan drivers falls short to bring minimum auto insurance policy coverage, the state does not need drivers to have underinsured or uninsured driver insurance coverage as some various other states do.

Furthermore, the lot of without insurance motorists in Michigan adds to high automobile insurance policy premiums. Vehicle insurance policy is most pricey for Michigan homeowners that stay in Detroit, where the standard has to do with $6192 per year, followed carefully by Dearborn, Flint, and Redford, where the typical cost tops $5000 annually - auto insurance.

com, Quote Wizard, as well as Value, Penguin, Detroit homeowners that live within the 48227 location code pay greater automobile insurance than anywhere else in the USA, with an average yearly premium price of $7415. Also wonderful vehicle drivers will pay high prices for insurance in metropolitan areas of the state, while chauffeurs living in backwoods often tend to benefit from reduced automobile insurance policy prices - cheapest.

Speeding tickets and other sorts of traffic tickets will additionally create your price to increase. Drivers who have speeding tickets in Michigan can get a policy for regarding $1697 for the year from GEICO.Boosting your credit report can additionally reduce your auto insurance expense. Chauffeurs with low credit report pay about 167 percent extra for auto insurance policy protection than motorists with great credit history.

Indicators on Michigan Car Insurance - Usaa You Need To Know

dui automobile car insured truckscheapest auto insurance laws vehicle insurance insurers

dui automobile car insured truckscheapest auto insurance laws vehicle insurance insurers

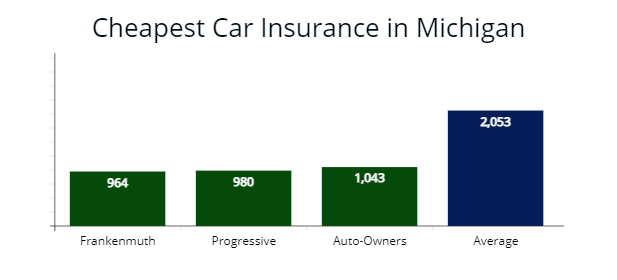

Michigan drivers with poor credit report should think about a policy with GEICO. This business provides the most affordable rates for vehicle drivers who don't have beneficial credit history, with an average premium price of $2128 for individuals in this group. Various other options for vehicle drivers with bad credit rating consist of: Progressive at $3320 annually, State Farm at $7232 each year, Farmers at $8511 per year, Allstate at $10,386 annually, According to Nerd, Pocketbook, these are the companies with the very best auto insurance coverage prices in Michigan:$2440 each year at Auto-Owners for vehicle drivers with good driving backgrounds and tidy credit scores$2576 a year from Frankenmuth$3168 a year from Esurance, Research study suppliers and also their alternatives to find one Visit this link of the most budget friendly car insurance policy, so you, your family members, as well as other chauffeurs will certainly be safeguarded when driving.

You might have the ability to locate more info regarding this and also comparable web content at piano. io.

Michigan was just one of 38 states that saw increased auto insurance policy prices in 2021, the record located (perks). In the Detroit metro location, where chauffeurs have actually paid much higher expenses for vehicle insurance, the typical premium was $3,148, a 2% increase from 2020. Comparatively, West Michigan chauffeurs in Grand Rapids, Kalamazoo as well as Battle Creek paid approximately $2,462 for vehicle insurance policy in 2021.

"Michigan is delaying behind, so I think that's an excellent indicator that that something is working over there."It's not likely Michigan drivers will ever have amongst the most affordable prices in the country, as chauffeurs in some states are presently paying much less than $1,000 a year, Beck stated. Over time, she said it's feasible Michigan might flaunt comparable prices to various other Midwest states."There's really no various other insurance policy factor why they couldn't reach a comparable price as neighboring states," she claimed.

Patrick Cooney, the assistant director of plan influence at Poverty Solutions at the University of Michigan as well as co-author of a recent analysis of Michigan's vehicle insurance coverage regulations, claimed while prices have actually dropped across the board, Detroit-area residents are still paying a whole lot even more to guarantee their vehicles. suvs."We still see this difference in rates in between Detroit and also the rest of the state, and really between any kind of postal code with a high share of Black citizens," Cooney claimed.

Cheap Car Insurance Michigan – Way.com for Dummies

One option Cooney said lawmakers might think about to make rates extra equitable across the board is requiring insurance service providers to compute most of their prices on three driving-related factors: miles driven, driving record as well as years of driving experience. credit score."If you maintain trying to bar all these variables they can't make use of, it can transform a little into a video game of whack-a-mole," he said.

Now, only vehicle drivers who select endless PIP clinical insurance coverage pay the MCCA evaluation, as long as the fund does not have a deficit. One of the most recent MCCA charge was $86 per automobile, below $220 in 2019 prior to changes to the state's automobile no-fault plans were authorized into law. A vehicle driver's PIP coverage political election will certainly not have an influence on the refund amount.

Beck stated reimbursements can help "restore a little bit of faith in the procedure" for consumers irritated with paying a great deal of cash for car insurance coverage."Exactly how insurance is expected to work is that it's there at your worst time," she said.

The Insurance Coverage Partnership of Michigan, which stands for a majority of insurance policy companies in the state, announced in December that more than 150,000 vehicle drivers formerly driving without cars and truck insurance have subscribed since modifications to Michigan's no-fault system entered into effect. Doctor claim the modifications have actually decimated their market and also placed individuals that suffered devastating injuries in risk - cheaper auto insurance.

Cooney said the College of Michigan evaluation concluded the price caps consisted of in the 2019 regulation could have been unnecessarily low, keeping in mind there are "a lot more nuanced means of managing this" that might enable suppliers to proceed to give treatment without driving up prices. In a December meeting with press reporters, Home Speaker Jason Wentworth, R-Farwell, said he's open to tweaks, indicating a $25 million pot of cash accepted by legislators for post-acute mind as well as spinal injury centers and also attendant treatment carriers seeing architectural losses as a result of the brand-new legislation.

Despite Cost Dip, Michigan Auto Insurance Still High With ... Things To Know Before You Get This

"Anything that we do will have that cause and effect on that particular check." (insure).

Auto insurance coverage in Michigan is costly since it's a no fault state with high insurance protection requirements. The largest reason Michigan drivers pay even more for car insurance coverage than anybody else in the nation is that it is the only state with limitless. In Michigan, you can expect to pay about $3,833 each year for complete coverage cars and truck insurance policy or $1,908 annually for minimum protection.

low cost cheaper car insurance company liabilityaffordable car insurance insurance dui automobile

low cost cheaper car insurance company liabilityaffordable car insurance insurance dui automobile

As the cost of auto insurance proceeds to increase, extra drivers take the danger of driving without cars and truck insurance policy. In 2019, 26% of chauffeurs did not have even minimum responsibility insurance coverage in Michigan.

auto insurance auto insurance low-cost auto insurancerisks cheaper car insurance cars credit

auto insurance auto insurance low-cost auto insurancerisks cheaper car insurance cars credit

In Michigan, weather events like extreme storms, significant wintertime climate, as well as droughts are ending up being progressively typical. These weather events trigger insurers to pay a higher number of cases, which have a tendency to be a lot more pricey as well as less predictable (cheaper auto insurance). Because of this, they have to raise rates to keep pace. Nevertheless, there might be various other issues boosting your rates.

Some things you can't regulate, yet you do have a say in a lot of the adding elements. Driving securely, complying with traffic laws, and maintaining a clean driving document are the very best ways to keep your insurance policy costs down. insurance. Apart from that, the ideal means to reduce your automobile insurance coverage costs is to contrast rates from a minimum of 3 insurance provider.

Not known Incorrect Statements About Westfield Insurance - Westfield Insurance

Yet at a minimum, make certain to check your document and buy prices every 3 to 5 years, given that you might be able to obtain a reduced rate if a website traffic infraction drops off your document - low cost auto. In Michigan, the most pricey policies cost about $7,950, and also the least pricey coverage costs around $266, when all driver profile info is the very same.