Consequently, if you select a $2,000 Medical Cost Limit, each passenger will certainly have up to $2,000 insurance coverage for medical claims resulting from a crash in your car. If you are associated with an accident as well as the various other chauffeur is at mistake yet has as well little or no insurance coverage, this covers the space in between your prices and also the other chauffeur's insurance coverage, approximately the restrictions of your insurance coverage (cheap car insurance).

The limitations required and optional limits that might be offered are established by state regulation. This protection, needed by law in some states, covers your medical costs as well as those of your passengers, no matter that was accountable for the mishap. The limits needed and also optional limits that might be offered are set by state legislation (cheapest).

The cash we make assists us give you access to free credit history as well as reports as well as aids us create our various other fantastic devices as well as academic materials (auto). Settlement might factor into exactly how and where items show up on our system (and also in what order). Yet considering that we generally make money when you find a deal you such as and obtain, we try to show you provides we assume are a great match for you.

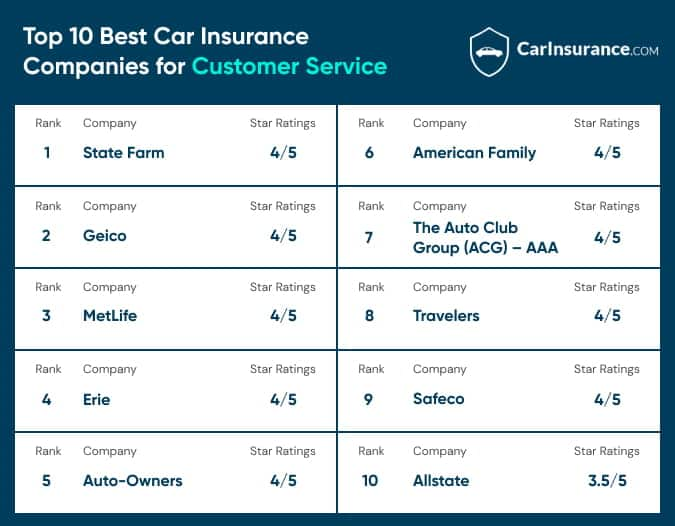

Among the most basic means to shop around for insurance policy coverage is to compare car insurance firms online. If you choose to evaluate insurance alternatives with somebody, collaborating with an automobile insurance policy representative is one more way to go. It's not just your driving document that figures out the insurance policy estimates you obtain.

Some Of Dmv - Idaho Transportation Department

They make use of insurance claims information as well as personal info, to name a few elements, to evaluate this danger. In some states, your credit history can have some influence on your premium (though California, Massachusetts and also Hawaii have actually all outlawed the method of making use of credit-based insurance policy scores to help figure out rates) (cheaper). As well as while it's somewhat debatable, making use of credit-based insurance policy scores to affect costs cost is still a fact, with studies and studies suggesting that those with less-than-ideal credit are extra most likely to make insurance policy claims and the other way around.

: Particular locations have higher-than-normal prices of mishaps and also lorry theft (low cost).

The extra pricey your auto is, the higher your insurance rates might be. Insurance firms can additionally consider whether chauffeurs with the exact same make as well as design often tend to file even more claims or remain in more crashes, in addition to safety and security test results, cost of repairs and also burglary price. Placing less miles on your automobile monthly can affect the prices you obtain.

cheapest car insurance companies cheaper cars business insurance

Data shows that the probability of a mishap may be connected to these aspects - money. Responsibility insurance coverage typically is composed of three sorts of protection: bodily injury liability coverage, property damages responsibility insurance and uninsured motorist protection. Each state that needs liability insurance policy has its own minimum insurance coverage demand, yet you can pick extra coverage at a price. They can all be at risk if you cause a mishap that results in medical or residential or commercial property damages expenses that surpass your coverage limit. You may desire to select coverage limits that, at minimum, show the worth of your combined possessions.

Facts About What Are The Different Types Of Car Insurance? - Nationwide Revealed

He delights in giving readers with details that can make their lives happier as well as more expansive - affordable car insurance. Warren holds a Bac Learn more. Learn more.

In these states, fault is not relevant in identifying who must pay for physical injury responsibility after a crash. Accident problems are covered by your very own insurance company, despite who is at mistake for an accident. No-fault states still require drivers to acquire home damage liability, and lots of also call for that you carry physical injury liability coverage also.

This option is made when you acquisition or renew your automobile insurance coverage. What obligation vehicle insurance does not cover Responsibility automobile insurance does not cover problems to your own car as well as person after a mishap. If you want your insurance firm to cover these problems, you will require accident as well as clinical insurance coverage.

Liability protection will certainly not spend for property damages and clinical costs for the various other driver if you are not responsible (cheaper cars).

9 Simple Techniques For 5 Factors That Affect Your Car Insurance Rate - The Personal

The typical vehicle insurance policy price for full insurance coverage in the United States is $1,150 each year, or concerning $97 per month. No insurance coverage can cover you as well as your car in every scenario. A 'complete protection cars and truck insurance' policy covers you in many of them. Full protection insurance coverage is shorthand for cars and truck insurance coverage plans that cover not only your liability but damage to your auto also.

A full coverage plan depending on state regulations might also cover without insurance motorist protection as well as a medical protection of individual injury defense or medical Go to this website payments. A typical complete protection insurance coverage will certainly not cover you as well as your vehicle in every situation. It has exclusions to particular cases. IN THIS ARTICLEWhat is full protection auto insurance? There is no such thing as a "complete insurance coverage" insurance plan; it is simply a term that refers to a collection of insurance coverage protections that not just consists of responsibility coverage yet accident as well as comprehensive.

What is taken into consideration full coverage insurance policy to one driver may not coincide as also another vehicle driver in the very same home. Ideally, complete coverage indicates you have insurance in the types and also quantities that are appropriate for your earnings, properties as well as run the risk of profile. The factor of all types of cars and truck insurance coverage is to maintain you from being financially spoiled by a crash or case.

Fees likewise differ by hundreds and even thousands of dollars from company to firm - perks. That's why we constantly recommend, as your very first step to saving money, that you compare quotes. Here's a state-by-state comparison of the average yearly price of the complying with coverage degrees: State-mandated minimum obligation, or, bare-bones protection required to legally drive an automobile, Complete protection obligation of $100,000 per person harmed in an accident you create, up to $300,000 per mishap, and also $100,000 for residential property damage you cause (100/300/100), with a $500 deductible for detailed and also crash, You'll see exactly how much full coverage auto insurance coverage expenses each month, as well as each year.

Some Ideas on How To Choose The Right Auto Insurance Policy - Experian You Need To Know

The average yearly price for full insurance coverage with greater obligation limits of 100/300/100 is around $1,150 even more than a bare minimum plan. If you select reduced obligation restrictions, such as 50/100/50, you can save but still have good protection. insurance. The average regular monthly cost to improve coverage from state minimum to complete coverage (with 100/300/100 limitations) is concerning $97, yet in some states it's a lot less, in others you'll pay more. cheaper cars.

Your auto, as much as its reasonable market price, minus your deductible, if you are at fault or the other driver does not have insurance or if it is damaged by an all-natural catastrophe or taken (comp as well as crash)Your injuries as well as of your passengers, if you are hit by a without insurance vehicle driver, approximately the limits of your uninsured motorist plan (uninsured motorist or ).

cheapest car cheapest car insurance vehicle insurance car insurance

cheapest car cheapest car insurance vehicle insurance car insurance

Complete protection cars and truck insurance plans have exclusions to details cases - vehicle insurance. Racing or various other rate contests, Off-road usage, Usage in a car-sharing program, Disasters such as war or nuclear contamination, Damage or confiscation by federal government or civil authorities, Using your car for livery or distribution objectives; organization usage, Deliberate damage, Cold, Use as well as tear, Mechanical malfunction (usually an optional insurance coverage)Tire damages, Items taken from the vehicle (those may be covered by your home owners or renters policy, if you have one)A rental vehicle while your own is being fixed (an optional coverage)Electronics that aren't completely connected, Customized parts as well as tools (some little amount may be specified in the policy, yet you can generally include a biker for greater quantities)Do I need complete insurance coverage automobile insurance policy?

You, as an automobile proprietor, are on the hook personally for any injury or property damages past the limits you chose. risks. Your insurance provider won't pay even more than your limitation. Yet responsibility insurance coverage will not pay to repair or replace your cars and truck. If you owe money on your automobile, your lender will certainly require that you get crash and detailed coverage to secure its investment.

The Single Strategy To Use For 3 Types Of Auto Coverage Explained - Country Financial

Below are some policies of thumb on guaranteeing any kind of cars and truck: When the automobile is new as well as funded, you need to have complete insurance coverage. Maintain your insurance deductible workable - auto insurance. When the car is paid off, raise your insurance deductible to match your offered cost savings. (Higher deductibles help reduce your costs)When you get to a factor economically where you can change your cars and truck without the help of insurance policy, seriously think about going down extensive as well as crash.

Below are a few tips to follow when looking for economical complete coverage car insurance: See to it you correspond when shopping your liability restrictions. If you pick in physical injury liability per person, in bodily injury liability per crash and in residential property damage responsibility per mishap, always go shopping the very same coverage levels with various other insurance providers (auto).

These insurance coverages become part of a complete protection plan, so a premium quote will be needed for these protections as well - vehicle insurance. Both accident and also detailed included a deductible, so be sure constantly to choose the very same insurance deductible when buying protection. Choosing a greater insurance deductible will certainly push your costs reduced, while a lower deductible will result in a greater costs.

There are various other coverages that assist make up a complete insurance coverage bundle - auto insurance. These coverages vary but can include: Uninsured/underinsured motorist coverage, Accident security, Rental reimbursement insurance coverage, Towing, Space insurance coverage, If you need any one of these additional coverages, always pick the very same insurance coverage levels as well as deductibles (if they apply), so you are contrasting apples to apples when looking for a new policy.

The Best Guide To Auto Insurance - Car Insurance

automobile business insurance auto insurance credit

automobile business insurance auto insurance credit

Can I drop full insurance coverage vehicle insurance coverage? Analyzing our data, we discovered that about of drivers that own a car a minimum of 10-years old are getting thorough as well as crash coverage. Other drivers might consider going down these optional insurance coverages as their vehicle nears the end of its life. If you can take care of such a loss-- that is, replace a swiped or totaled vehicle without a payout from insurance coverage-- do the mathematics on the possible savings as well as consider dropping coverages that no longer make good sense.

Going down comprehensive and also crash, she would certainly pay concerning a year a savings of a year. Allow's say her vehicle deserves as the "real money value" an insurance provider would certainly pay. If her cars and truck were amounted to tomorrow as well as she still brought complete coverage, she would certainly get a check for the cars and truck's actual money value minus her insurance deductible.

Of program, the car's worth drops with each passing year, and so do the insurance coverage costs - prices. Full insurance coverage automobile insurance coverage Frequently asked question's, How much is complete coverage insurance policy on a new automobile?