Numbers 2) as well as 3) may be replaced by your credit report card protection (see details for charge card protection). insurance companies. Inspect before you lease, as well as obtain it in composing. Some bank card companies have exclusions specifically versus Latin American leasings. Some rental firms do not permit you to waive this insurance no matter of various other insurance coverage.

The price varieties from $US 10-20 per day depending upon the automobile. This insurance coverage does not cover your rental vehicle at all, only damages to various other individuals, their cars, or property. Unless you acquire supplements, or have documented insurance coverage from your bank card you are still responsible for all problems to the rental vehicle.

Extra Confusion, The confusion as well as aggravation included in obtaining a reasonable rate on a car leasing obtains worse before it obtains far better. Some rental vehicle companies swelling the price of one or more sorts of insurance policy into the rental cost, others combine the government insurance coverage in their CDW or LDW coverage, and also others seem to purposefully puzzle the three kinds in order to make their rates appear better. liability.

If you choose among the plans from the rate contrasts using this web link we will certainly get a reference charge. Test search results for travel insurance coverage on a $4,222 journey for two to Costa Rica Journey Insurance Policy Coverage Charge Card Protection Earnings Intention Insurance and also Damages Waivers are a major income source for the rental companies because they are generally pure earnings.

Some Known Details About The Ins And Outs Of Rental Car Insurance - The General

cheaper cars low cost auto cheapest auto

cheaper cars low cost auto cheapest auto

The rental firm only pays concerning $2 per day to the INS for the government mandated SLI yet then charges in between $15 as well as $35 a day. The CDW "insurance coverage" is a lot more lucrative due to the fact that 99% of the moment no damages takes place and also in the unusual cases that it does it's almost constantly covered by the $2,000 insurance deductible that the renter still has to pay out of pocket even if they went with CDW protection. prices.

We rely on our cars to deliver us to a variety of necessary locations: school, work, the grocery shop, doctor's appointments and also countless various other stops throughout our every day life. risks. Nevertheless, every day life can conveniently grind to a halt when you do not have the use of your automobile and also in this situation a rental car might be the means you need to go.

Whether you have had an accident, are taking a trip, or are just having your car serviced, rental auto insurance is the included protection you require for rental vehicle advantages, as well as Bankrate has some suggestions to assist you discover the appropriate coverage for you. Kinds of rental cars and truck insurance coverage, Rental vehicle insurance is somewhat comparable to routine auto insurance policy.

Nonetheless, the kinds of rental vehicle insurance are a lot various than car insurance policy. Before obtaining rental cars and truck insurance coverage, you need to be mindful of your choices. One of the most usual kinds of rental vehicle insurance coverage include: Sometimes called the crash damage waiver (CDW), this is a waiver, rather than a true policy (accident).

Some Ideas on Can You Rent A Car Without Insurance? - Avis Car Rental You Should Know

affordable trucks cheap auto insurance vans

affordable trucks cheap auto insurance vans

If you have accident as well as extensive auto insurance, this might be included in your policy - car. Your very own liability insurance policy might cover these instances, even when you are driving a rental cars and truck.

This protection pays for any kind of belongings that might be taken from your rental cars and truck. In this case, your home owner's insurance policy or occupant's insurance coverage may provide comparable protection. cheap insurance. While there are numerous various kinds of rental auto insurance coverage, it does not cover every little thing. As an example, you would not use this kind of plan to be reimbursed for the cost of renting a car while your regular vehicle is being fixed as component of a claim.

When do you require rental cars and truck insurance policy? Knowing when you need car rental insurance policy is not constantly clear. If you just require a rental vehicle for a couple of days at the majority of, you might be tempted to miss it. For some individuals, their individual auto insurance plan instantly covers rental cars and trucks. insurers.

Otherwise, your personal policy will certainly not cover the repair work if you enter into an accident or if something else happens to the automobile that causes damage."If you additionally have accident and thorough automobile insurance, they cover physical damages and might include a rental cars and truck. However, state legislations vary, so make certain to consult your insurance provider," claims Adams (vehicle).

Not known Details About Rental Car Insurance

Exactly how much is rental cars and truck insurance? The price of rental automobile insurance depends on a couple of aspects.

Rental cars and truck insurance coverage provided by your credit scores card business is generally additional insurance coverage. That implies if you obtain right into an accident or the cars and truck obtains taken, your vehicle insurer will certainly get billed first. If that holds true, your insurance deductible will put on the case. insured car. There are some charge card companies that provide main rental car insurance policy, although it is much less typical.

You can call your charge card business to identify if your card provides rental car insurance policy and also what type of insurance they offer. Many significant bank card companies, like Visa, Master, Card and also American Express all offer some type of rental vehicle insurance for their cardholders. To make use of the protection, you usually need to spend for the rental automobile using the card and lease the automobile in your name.

State Farm, Allstate, Geico as well as Farmers all use the option to have some sort of rental car insurance protection consisted of in their routine car insurance policies. If you are covered, it comes at no additional price past what you are currently paying for your month-to-month premium. As mentioned over, your auto insurance policy may offer similar insurance coverage to the loss-and-damage waiver, the additional responsibility protection or the personal crash defense.

Things about Rental Car Insurance: Does My Insurance Cover It?

It usually goes along with extensive and collision plans or supplemental defenses with higher protection restrictions. If you are asking yourself if you are covered, the very best thing that you can do is to review your automobile insurance coverage or to ask your insurance agent straight (cheapest car insurance). "Before your following trip, do your homework by evaluating your car insurance coverage policy or talking with your insurance provider concerning exactly how much rental cars and truck insurance you might require," recommends Adams.

automobile car insurance car credit

automobile car insurance car credit

cheaper car insurance insurance company insured car laws

cheaper car insurance insurance company insured car laws

Frequently asked inquiries, Do you require insurance policy on a rental auto? The truth is that you must have some kind of insurance on your rental automobile, whether it comes from the rental automobile business, your vehicle insurance coverage, your credit score card or an independent insurance provider.

There are four sorts of insurance policy protection to choose from, consisting of liability coverage, personal accident insurance policy, individual impacts coverage and also a loss damage waiver. After receiving a quote from your rental automobile company, make sure to contrast pricing as well as coverage against various other options. Is a rental automobile covered by my insurance coverage? Possibly.

Exactly how will an accident in a rental vehicle impact my insurance?, whether it is in your automobile or a rental automobile.

7 Easy Facts About How To Decide If You Need Rental Car Insurance - Arag Explained

Anytime you sue that is affixed to your vehicle insurance plan, the business will know you had an accident and will likely boost your rate accordingly (insure).

Additionally referred to as transport cost or rental car coverage, this can assist pay for a rental vehicle if your automobile obtains damaged in an accident or one more covered event. It is very important to understand that the transport expense does not cover your rental vehicle for a holiday. Rental car insurance policy can really help when you require it most.

Just How to Make Use Of Mishap Rental Vehicle Repayment Mishaps occur. If you're in an automobile accident, rental vehicle repayment insurance coverage, likewise called transportation expense protection, can help pay for a leasing while your automobile obtains dealt with.

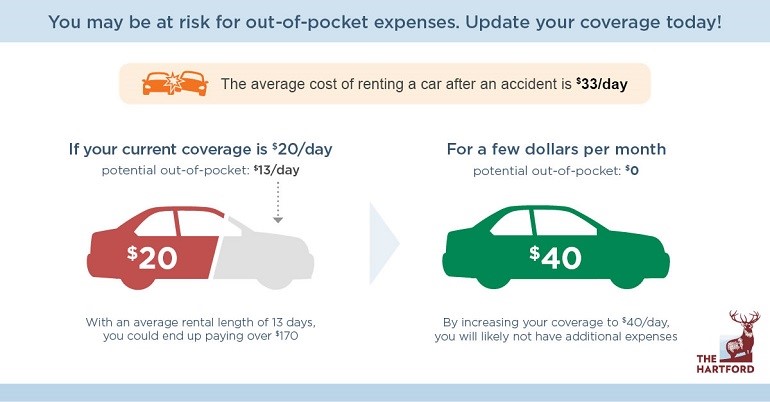

You can pick your everyday limitation based on just how much you think it'll set you back to rent out a car in your area. Your transport expense coverage may limit the kinds of lorries you can lease prior to having out-of-pocket costs. If you select a reduced amount of coverage and your day-to-day rental lorry expenses surpass your insurance coverage restrictions, you'll have to pay the difference out of pocket.

Get This Report about California: Car Rental Insurance Requirements - Tripadvisor

Get a Quote We're an insurance coverage business backed by decades of experience. 1 We can help you understand the distinctions in between rental automobile insurance policy and rental cars and truck reimbursement.

Photo: If you have actually ever leased a cars and truck, you probably dread the moment when the rental auto agent asks if you wish to buy rental vehicle insurance coverage. Even if you determine in advance that you don't require it, the rental automobile agent may try to persuade you otherwise. affordable. You might also second-guess your decision not to purchase it.

You will have the same protection as you would certainly if you were driving your personal vehicle, subject to your policy's exemptions and constraints. Obviously, if you do not carry comprehensive and crash on your very own car and your rental car obtains stolen or damaged, you can be responsible for the loss.

As an example, a platinum card might offer even more coverage than a gold card. Consult the bank card business you prepare to use to pay for the rental cars and truck before your journey so you understand what your choices are. The insurance policy coverage the rental automobile company offers to you is often called loss damages waiver (additionally referred to as accident damages waiver or CDW) as well as it isn't in fact insurance policy.

Some Known Factual Statements About Should You Add Rental Car Reimbursement To Your Auto ...

They also may supply additional responsibility protection that exceeds what they currently lug, which is usually the minimum called for by state law. Your very own auto plan might have higher limits, so acquiring the added obligation coverage from the rental cars and truck firm might imply you are spending for something you just don't need.

Talk to the rental automobile firm you prepare to make use of prior to your journey so you recognize what your options are. If you just carry liability on your car, you may desire to consider the extra protections provided by the rental automobile agency - credit. The additional price may be worth it to stay clear of bigger costs if the auto remains in a mishap or swiped.

Let's say you have an accident in a car you leased (auto). The moment it requires to repair the automobile is time the vehicle can have in theory been leased to another person. Due to the fact that the car might not be leased while it was being repaired, the rental auto car firm may desire you to pay a fee for the quantity of time the car was out of payment.